Apple begins iPhone Pro production in India as next-gen assembly starts

Screenshot

Apple has commenced manufacture of iPhone Pro series smartphones in India as it ramps up production of the devices there, Canalys data claims. The analysts also note Apple has seemn growth in emerging Asia-Pacific market to achieve 19% smartphone market share and 55 million shipments.

Apple drives US smartphone market

“The US smartphone market stood out, growing 12% year on year in Q1, primarily driven by Apple,” said Le Xuan Chiew, Research Manager at Canalys (now part of Omdia). “Apple proactively built up inventory ahead of anticipated tariff policies. While iPhones produced in Mainland China still account for the majority of US shipments, production in India ramped up toward the end of the quarter, covering standard models of the iPhone 15 and 16 series, alongside accelerating production of the 16 Pro series.”

Apple’s shift to production in India is very much in the mind of the analyst firm. Chiew continued:

“With ongoing fluctuations in reciprocal tariff policies, Apple is likely to further shift US-bound production to India to reduce exposure to future risks. Tariffs are also expected to disproportionately impact entry-level devices, potentially reducing the availability of lower-cost models and driving average selling prices (ASPs) higher in the US. These dynamics introduce new uncertainties not only for Apple but also for Android brands competing in the market. Pricing strategies, operator bundling packages and future product structures will come under significant pressure. Meanwhile, the US smartphone market is expected to experience considerable volatility over the next two to three quarters, impacted by inventory corrections and weakening consumer confidence.”

What happened overall?

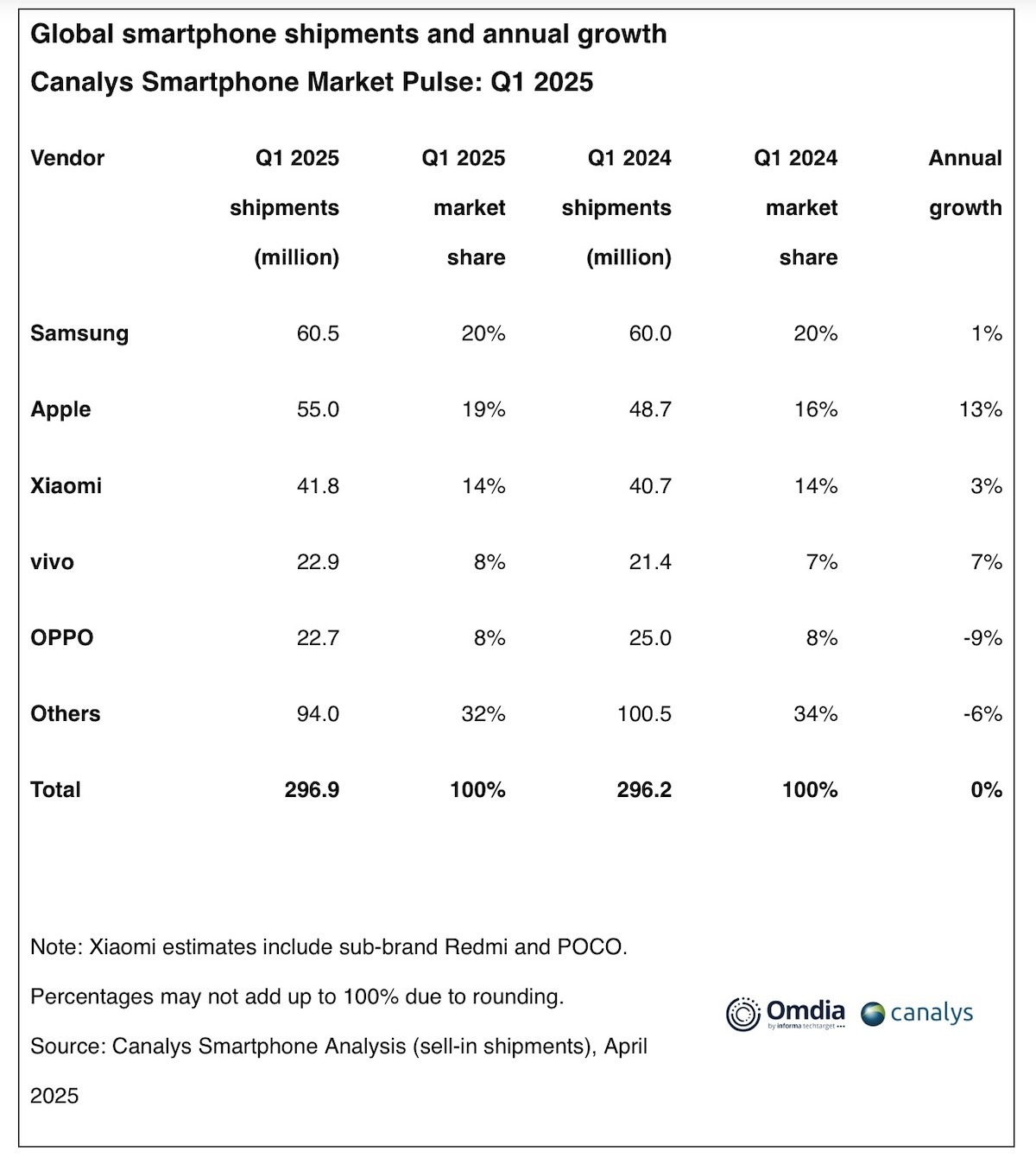

Smartphone shipments reached 296.9 million units in Q1 2025, they said. As the peak replacement cycle came to an end and vendors prioritized healthier inventory levels, global smartphone market growth slowed for the third consecutive quarter.

“The regional smartphone landscape is becoming increasingly complex,” said Toby Zhu, Principal Analyst at Canalys (now part of Omdia). “Markets that had shown strong momentum over the past year, such as India, Latin America, and the Middle East, are now experiencing notable declines in Q1 2025, indicating saturation in replacement demand for mass-market products. Most Android brands actively adjusted inventory levels in Q1 to avoid disruptions to new product launches and channel pricing. The European market has also dropped after a brief recovery, with vendors facing high flagship inventory from late last year and disruptions in mid- and low-end product lines due to the upcoming eco-design directive. Nonetheless, some regions are still demonstrating strong demand. Government subsidy programs stimulated Mainland China’s growth, while Africa continued to benefit from vibrant retail activities and proactive market expansion efforts. Vendors can still expand by optimizing their product portfolios in this complex regional environment. For instance, vivo and HONOR achieved double-digit growth in their overseas markets, with HONOR reaching a historic high in its overseas shipments.”

And the top five are…

Samsung sold 60.5 million units, ahead of Apple which ranked second with 55.0 million units shipped. Xiaomi shifted 41.8 million units, while vivo and OPPO followed in fourth and fifth places, with shipments of 22.9 million and 22.7 million units, respectively.

You can follow me on social media! Join me on BlueSky, LinkedIn, Mastodon, and MeWe.